eInvoicing in the UAE

eInvoicing Impact Assessment and Implementation

CLA Emirates [formerly Emirates Chartered Accountants Group] brings proven expertise in conducting e-Invoicing impact assessments and guiding businesses through seamless implementation, with clarity, precision, and confidence.

Call for Consultation

Mr. Arun Sankaran | Associate Director - Management Accounts

+971 50 193 4860

Email: Arun.Sankaran@claemirates.com

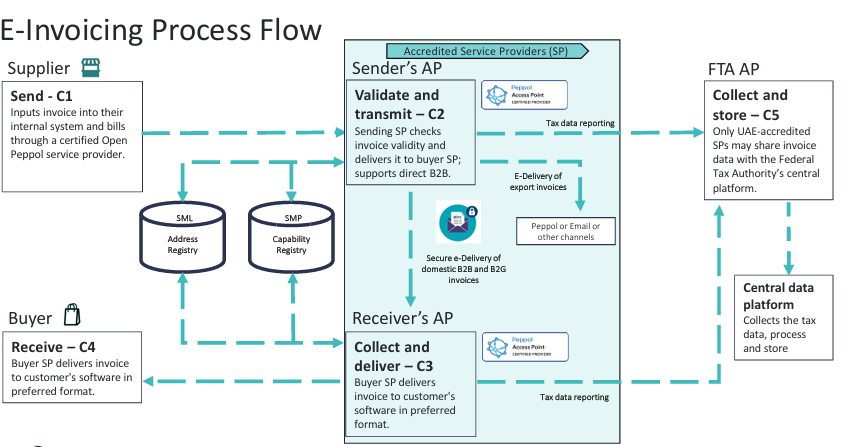

How the UAE eInvoicing System Works

| Step | What Happens |

|---|---|

| 1 | The supplier creates an e-invoice in XML format |

| 2 | Sender’s ASP validates & transmits it |

| 3 | buyer’s ASP collect, validate & deliver |

| 4 | buyer receives the invoice |

| 5 | In parallel, the sender’s and buyer’s ASP reports tax data document (TDD) to FTA |

Note: Only invoices in structured digital formats (not PDFs or scanned copies) are accepted as valid e-invoices.

Why Choose CLA Emirates?

CLA Emirates is a leading audit, tax, and advisory firm in the UAE, helping businesses navigate e-invoicing compliance with confidence. With a presence in Dubai, Abu Dhabi, Sharjah, and JAFZA, we offer end-to-end support tailored to UAE regulations and the FTA framework.

Our services include:

1. Readiness Assessment and Gap Analysis

- Review existing invoicing processes and ERP capabilities

- Identify compliance gaps based on local e-Invoicing mandates

2. Regulatory and Compliance Advisory

- Guide your team on Peppol framework, PINT AE standards, and FTA specifications

- Clarify technical and VAT compliance requirements for your industry

3. ERP and System Integration

- Align your accounting or ERP software with e-Invoicing data formats (XML)

- Ensure compatibility with the FTA’s portal or certified access point

4. Technology Partner Coordination

- Connect you with reliable, FTA-approved technology providers

- Facilitate the implementation of scalable e-Invoicing solutions

5. Employee Training and SOP Development

- Train finance and IT teams on new invoicing workflows

- Create internal documentation for seamless operations

6. Post-Implementation Support

- Offer continuous monitoring, updates, and compliance reviews

- Support with audit preparation and error resolution