Do You Know that the Due Date for Annual Return Related to ESR in Cayman Island is Extended?

Yes, the Annual Return related to Economic Substance in Cayman Island is extended. As per the initial guidelines issued by the Authority, the Annual Return has to be reported to the authority by 31st March 2020 for the financial year ending December 2019.

But as a result of Coronavirus (COVID-19) pandemic and due to disruptions to regular operations the deadline to file Annual return has been extended to 30th June 2020 by Registrar of Companies (ROC) and the Department for International Tax Co-operation (DITC). Also, the due date to file Economic Substance Notification filings will be 30th June 2020.

Any penalty for failure to file a Report or notification will come into effect only from 1st July 2020.

Economic Substance Law in Cayman Island

The Economic Substance in Cayman Island Law cited as the International tax Co-operation Law 2018 was introduced in Cayman Island in December 2018 and is in effect from 1st January 2019. This law provides for the Substance test which needs to be satisfied by certain entities and for incidental and connected persons.

As per Section 4 of this Law, a “Relevant Entity” that carries “Relevant Activity” is required to satisfy the Economic Substance test about that Relevant activity.

As per the Schedule to the law, Relevant Activities to which Economic Substance is applicable are as below:

- Banking business

- Distribution & Service Centre business

- Financing & Leasing business

- Fund Management business

- Headquarters business

- Insurance business

- Intellectual property business

- Shipping business

- Holding Company business

It means if any licensee carries out any of the above-mentioned activity, then it will have to comply with the requirements of Economic Substance Law. As per Section 4(2) of the law, the relevant entity meets the Compliance requirements of the law if it satisfies the below-mentioned points:

- The relevant entity conducts the Core Income generating Activity (CIGA) in the Cayman Islands

- The business to the relevant activity is directed and managed inappropriate manner in the Cayman Islands

- Following expenses are incurred in the Cayman Islands in regard to the relevant income derived from the relevant activity:

- An Adequate Amount of operating expenditure is incurred to conduct the relevant activity

- Adequate physical presence in terms of maintaining the place of office (physical premises), fixed assets, equipment, etc.

- Employs an adequate number of full-time qualified employees and other personnel

What does the relevant entity require to do to comply with Economic Substance in Cayman Island?

- A relevant entity has to notify the Authority on below points:

- Whether it is carrying out the relevant activity

- Date of the end of its Financial year

- Whether or not all or any part of its gross income in relation to the relevant activity is subject to tax in a jurisdiction outside the Cayman Islands, and needs to provide appropriate evidence for tax residency.

- In cases where the entity is a tax resident outside the Cayman Islands then details pertaining to Ultimate Parent, beneficial owner, date of the end of Parent Company’s financial year.

- For cases where the relevant entity carries out the relevant activity, then such entities have to submit a report to the Authorities in form of Annual return no later than 12 months after the last day of the end of its financial year of the relevant entity.

What are the Penalties in case of Non-compliance with Economic Substance in Cayman Island?

- Failure to satisfy compliance requirements:

In case of failure in 1st Financial year: $10,000 on failure to satisfy with Economic substance test

In case of subsequent failure: $100,000

- Failure to submit the report to Authority: $ 5,000 + $500 for each day during the failure continues

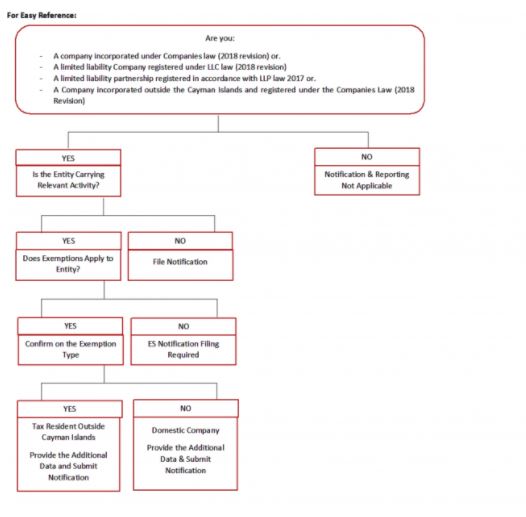

For Easy Reference:

For your enquiries on Economic Substance Notification in JAFZA

Contact Persons:

CA. Manu Palerichal

Email: manu@claemirates.com

Mobile:+971 50 282 8727

CA. Dhara Yagnik

Email: dhara@claemirates.com

Mobile: +971 56 595 6836

-

Feb 02,2026Why ESG Matters in the UAE?

Feb 02,2026Why ESG Matters in the UAE? -

-

-

-

Jan 15,2026UAE VAT Profit Margin Scheme 2026 Guide

Jan 15,2026UAE VAT Profit Margin Scheme 2026 Guide