- Feb 20,2023

- All | Corporate Tax in UAE

Steps to Register for UAE Corporate Tax

On 22nd January 2023, the Federal Tax Authority (FTA) launched corporate tax registration through EmaraTax in line with Federal Decree-Law No. 47 of 2022 on Taxation of Corporations and Businesses (“CT Law”).

Who is required to register for Corporate Tax in UAE?

The FTA requires all taxable persons (both legal and natural) to register for corporate tax (‘CT’) and obtain a Tax Registration Number.

|

Legal Persons |

Natural Persons |

|

UAE Public Joint Stock Company |

Individual |

|

UAE Private Company (incl. an Establishment) |

Sole Proprietorship/Establishment or Civil Company |

|

UAE Partnership |

Partner in a Partnership |

|

Foreign Company Club or Association or Society |

Other |

|

Trust |

|

|

Charity |

|

|

Foundation |

|

|

Federal Government Entity |

|

|

Emirate Government Entity |

|

|

Other |

|

At present CT registration is open for the UAE Public Joint Stock Companies and UAE Private Companies (incl. an Establishment).

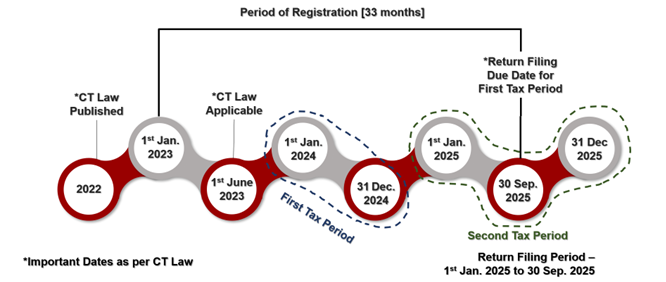

What is the registration timeline for Corporate Tax in the UAE for businesses with a financial year of January 1st to December 31st?

As per the information available on the FTA website, a taxable person would get time up to the date of filing of first Tax to register. i.e. for taxable persons having a year ending 31 May, a period of 26 months is available for registration (until 28 February 2025). For taxable persons with a financial year ending 31 December, a registration period of 33 months is available (i.e until 30 September 2025).

FTA has released a User Manual containing guidelines and instructions to navigate through the EmaraTax portal.

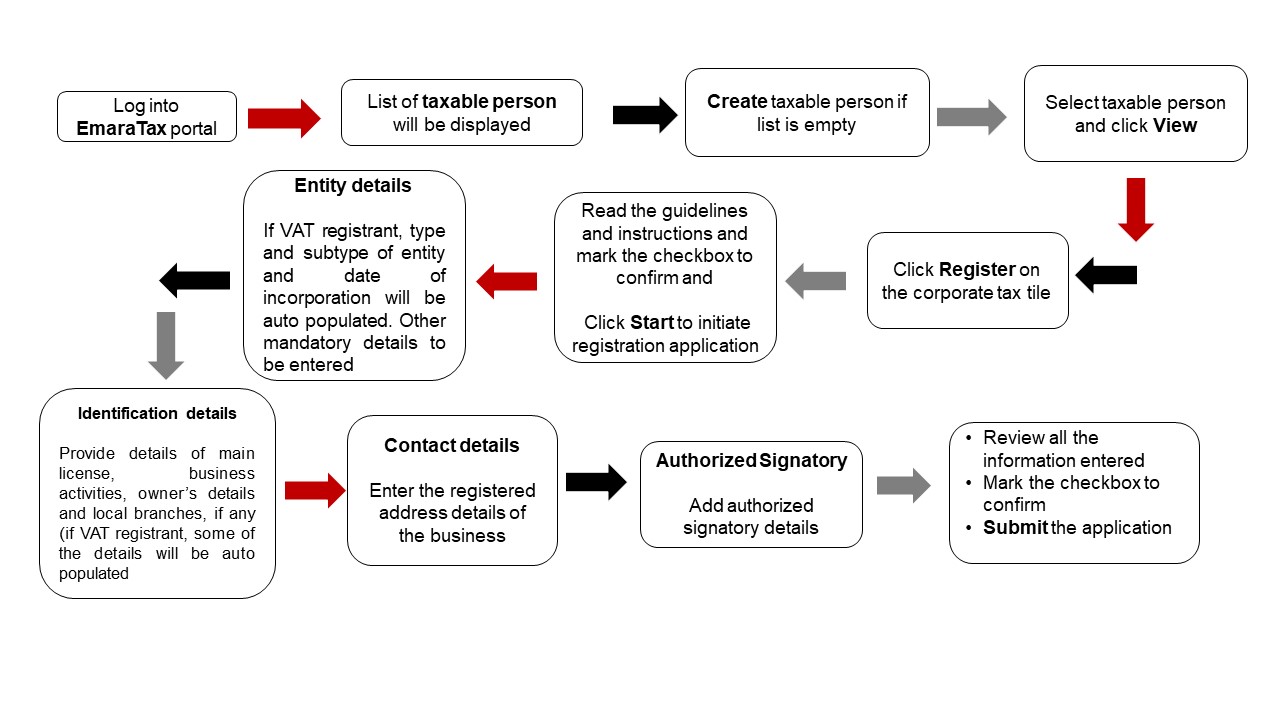

The following is the overview of Corporate Tax Registration in the UAE:

Guide to Registering Corporate Tax in UAE:

To register for corporate tax in the UAE, follow these 11 simple steps:

- Log in to the EmaraTax portal by clicking on eservices.tax.gov.ae and entering your registered email address and password. If you don't have an account, you can sign up by clicking the 'sign-up' button. If you have an account with the FTA but haven't migrated yet, you will need to reset your password before logging in to the EmaraTax portal. You can also login to EmaraTax portal with UAE Pass.

- A list of taxable persons will be displayed, and if it's empty, you'll need to create a new one. To do this, enter the profile name in English and Arabic, the preferred language and communication channel, and click 'Create'.

- Select the taxable person from the list and click 'View' to open the dashboard.

- Click 'Register' on the Corporate Tax tile within the Taxable Person dashboard.

- Read the guidelines and instructions, confirm by marking the checkbox, and click 'Start' to initiate the CT registration application.

- In the entity details section, provide details about the entity type, sub-type, and date of incorporation. Some of the details will be automatically filled in if you are VAT registered. Click 'Next Step' after filling out all mandatory fields to proceed to the 'Identification Details' section.

- In the identification details section, provide details about the license, business activities, ownership details, and local branch details. Click 'Next Step' after filling out all mandatory fields and proceed to the 'Contact Details'.

- In the contact details section, enter the registered address details of the business. If the business has multiple addresses, provide details of the place where most of the day-to-day activities are carried out. Click 'Next Step' after filling out all mandatory fields to proceed to the 'Authorized Signatory' section.

- In the authorized signatory section, enter the details of the authorized signatory, and upload the required documents, such as an Emirates ID/Passport copy of the authorized signatory and proof of authorization. You can add more than one authorized signatory if needed. Click 'Next Step' after filling out all mandatory fields to proceed to the 'Review and Declaration' section.

- In the review and declaration section, carefully review all the information entered on the application, mark the checkbox to declare the correctness of the information, and click 'Submit' to submit the Corporate Tax Registration application.

- After submission, the FTA will approve, reject or send back the application for resubmission for additional information and notify the applicant accordingly.

Way Forward: All legal entities, including those operating as part of a group, are required to register for corporate tax. We suggest that entities with a common owner, forming part of the group should evaluate which entity should form the part of "Tax Group", before registering with the Authorities. However, single entities may go ahead and register themselves. Further, one needs to be aware that the deadline for registration is the deadline for filing of the first tax return. Therefore there is sufficient time for the registration of an entity.

Contact Us for Corporate Tax Support in the UAE

Purvi Mehta

Manager – Direct Tax

M: +971 52 2800480

E: purvi@claemirates.com